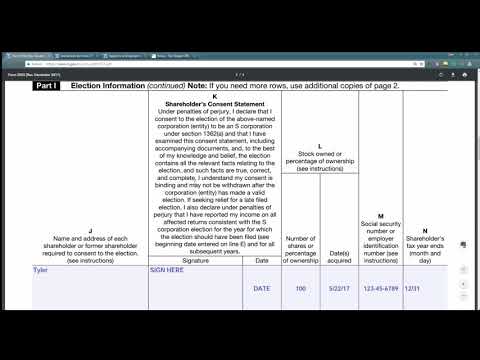

And welcome to the Ginger CPA. My name is Tyler, your host of the Ginger CPA YouTube channel. I also run a blog/website, thegingercpa.com. Thanks for tuning in. If you do like this video or have derived some kind of value from watching this video, please leave a like, consider subscribing, and consider checking out some more of my content on thegingercpa.com. So, let's get started. This video is about how to successfully file Form 2553, the S corp election form. This form can be kind of daunting and intimidating for people who have never really maneuvered through tax forms other than the regular 1040 tax form or their local state tax forms. But let me kind of ease your burden a little bit and let you know that this is just an informational form. There are no numbers going in here and no calculations, just basic information. So, let's break it down. Part 1 is about election information. You'll have your corporation name, which you probably have already decided on when completing your articles of incorporation, filing any kind of state paperwork, or any attorney paperwork. Make sure that this name on this line matches the name on the other forms that you have already filled out. Then, include the address in the city or state that you'll be doing business in. Next, you need to provide your Employer Identification Number (EIN). This is a must. You cannot successfully elect S corporation status without having an EIN. If you are starting a business for the first time, you probably don't have any prior experience with EINs. Here's how to get your EIN: go to the IRS's EIN Application website (irs.gov) and determine if you're eligible (which you probably are). Then, fill out the online application on the IRS website. Don't try to...

Award-winning PDF software

Who needs 2441 Form: What You Should Know

What's the Child and Dependent Care Credit? Read This Form 2441, Child and Dependent Care Expenses — SmartAsset.com When I Did This, It Made Me Feel Different If, like my friend and I did recently, the thought of having a second income from a side hustle made you get out the checkbook, consider your financial situation a bit more... What I Saw in the Tax Refund I Wrote It Was a Lot to Do It was a great read and I had a lot to say.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 2441, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 2441 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 2441 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 2441 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Who needs Form 2441