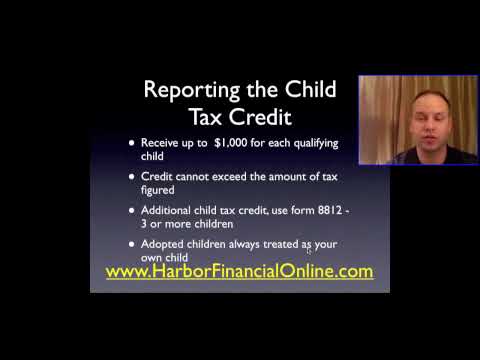

Welcome back to another video for Harbor Financial Online.com. Today, I'm going to be talking about the child tax credit. I'm going to go over the worksheet and show you how to get this credit and the requirements set by the IRS. Let's get the video started and walk through this together. The child tax credit worksheet and calculator have some basic requirements. First, you must be a US citizen and a resident of your household for at least half of the year. Additionally, you must have a valid social security number. These are the most basic requirements to get the credit. To determine your credit amount, you need to fill out a worksheet. I will show you this worksheet, and the total from it will be put on your tax return for the credit. Let me take you to our website, Harbor Financial Online.com, where you can calculate this credit and prepare the return online. Now, let's go to the actual worksheet that you have to complete to get the credit. You can find this worksheet on the IRS website. Just print it, input the numbers, and see what your credit would be. I recommend doing the return online to make the process easier. Here is the actual child tax credit worksheet. It requires you to fill in various amounts and check es. If you do the return online, it will automatically do this for you and calculate the exact credit you will receive. As you work through part two of the worksheet, you will reach line 13, which represents your total child tax credit. That's it for now. Thanks for watching the video.

Award-winning PDF software

Child care tax credit calculator Form: What You Should Know

Dependent Care Expenses Calculation. The dependent care expenses calculator is designed to assist you in determining your dependents and the maximum amount you could be paying toward their care each calendar year if you itemize your deductions and do not claim any standard deduction. Dependent Care Expenses 2025 – 2025 Dependents 2018 If your Dependents include: the amount deducted on Schedule A of form 2106 you may be able to claim the value on Schedule A of Form 1040 for that year if eligible under the dependent care exclusion. If your dependents have less than a 3,500 cost of care, and it is not required under the Family Care Expenses rules, you may be able to take a standard deduction for the entire care cost. For details go to the IRS publication, Tax on Unrelated Business Income. The total dependents and standard deduction amount are the following: 10,000 5 people 1,000 for each child 2,500 each for 2nd, 3rd & 4th dependents. This doesn't include the cost of any food or clothing provided for the child. 2018 – 2025 Family Care Expenses 2019 Expenses do not include the value of any food, clothing, medical care and transportation provided. 2021 Dependent Care Expense Calculator 2025 – 2019 Tax Year 1. Use the tax year calculator to determine the total family care expenses for the tax year for all dependents up to age 22. 2021 Child Tax Credit Calculator 2019 Total Family Care Expenses from Step 1. For any additional dependents and dependent care expenses that you might be eligible to claim for tax year 2025 on the 2025 Form 1040, go to our 2025 Dependent Care Expenses calculator to determine the total of your family care expenses for those years. If you choose to claim a standard deduction, add the standard deduction amount on line 21 to the total. If you are eligible for the additional child care expenses deduction, you can see your deductions for 2025 on form 1040. The total dependents and standard deduction amounts are the following: 10,000 5 people 2,500 for each child 10,500 each for 2nd, 3rd & 4th dependents.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 2441, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 2441 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 2441 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 2441 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Child care tax credit calculator